Equalizes the tax treatment of the purchase of health insurance for individuals and employers.However, this subsidy is unavailable for those that do not receive their insurance through an employer but instead shop for insurance on the individual market. Individuals who receive health insurance through an employer are able to exclude the premium amount from their taxable income.Prior to Obamacare, HIPAA guaranteed those within the group market could obtain continuous health coverage regardless of preexisting conditions.Įqualize the Tax Treatment of Health Insurance: Restores HIPAA pre-existing conditions protections.Provides a two-year open-enrollment period under which individuals with pre-existing conditions can obtain coverage.Protecting Individuals with Pre-Existing Conditions: Individual and employer mandates, community rating restrictions, rate review, essential health benefits requirement, medical loss ratio, and other insurance mandates.

Stay tuned for more details and insightful analysis here on the Sovereign Patient we will post them as available.Įffective as of the date of enactment of this bill, the following provisions of Obamacare are repealed:

The flexible, market-friendly Interstate Market for Health Insurance Cooperative Governing of Individual Health Insurance Coverage will be a welcome change. The expansion of uses and benefits of HSAs is robust and will go along way to establishing more ways to self-insure and less reliance on networks and government programs both are a good thing. We need more details about how tax equalization in the group market vs the individual market will be handled. View CRS reports for S.Lots to like and consider here. Strengthening Behavioral Health Parity ActĮmergency Direct Payments for Families and Workers Act of 2020Įducating Consumers on the Risks of Short-Term Plans Act of 2019 Small Business Emergency Savings Accounts Act of 2020

OBAMACARE REPLACEMENT ACT S 222 CODE

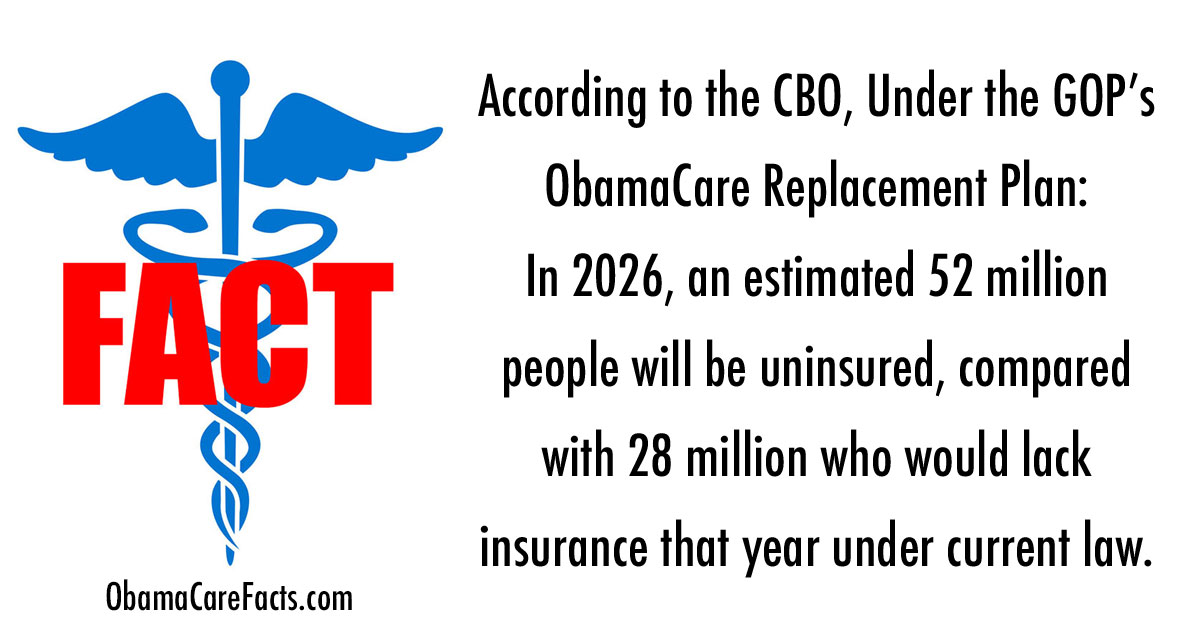

To amend the Internal Revenue Code of 1986 to allow an above-the-line deduction for health insurance premiums. Incentivize Growth Now In Tomorrow’s Entrepreneurs Act of 2017 To amend the Internal Revenue Code of 1986 to include certain over-the-counter medical products as qualified medical expenses. Small Business Health Account Act of 2018 Show More Related Bills in the same Congress: Stop-loss insurance obtained by certain health plans or plan sponsors is exempt from requirements for health insurance. The bill exempts health care professionals from federal and state antitrust laws in connection with negotiations with a health plan to provide health care items or services. The Centers for Medicare and Medicaid Services must (currently, may) waive Medicaid requirements to enable states to carry out experimental, pilot, or demonstration projects. Individual health insurance coverage is governed by the laws of a state designated by the health insurance issuer. The bill provides for the establishment and governance of: (1) independent health pools, which are entities that form risk pools to offer health insurance coverage to their members and (2) association health plans, which are group health plans sponsored by business associations. Physicians may deduct uncompensated and charity care. The tax deduction for medical care is expanded to include exercise equipment, exercise or health instruction, gym memberships, nutritional supplements, and periodic, pre-paid, or capitated primary care fees. HSAs may be used to pay for over-the-counter medications and health insurance in addition to currently allowed medical expenses. The bill eliminates HSA contribution limits and allows all individuals to make contributions to HSAs. The bill allows a refundable tax credit for a percentage of health insurance premiums and a tax credit for health savings account (HSA) contributions. This bill amends the Internal Revenue Code, the Public Health Service Act, the Employee Retirement Income Security Act of 1974 (ERISA), and the Social Security Act to repeal certain provisions regarding health insurance, including: the requirement for individuals to maintain minimum essential coverage, limitations on insurers varying premiums by age or health status, requirements for health insurance to cover preexisting conditions and the essential health benefits, and the prohibition on lifetime or annual limits on benefits.

0 kommentar(er)

0 kommentar(er)